(I)nbound (M)igrants (X)panding (I)nternational Remittances

Intermex benefits from ongoing inbound US migration trends & leverages a differentiated agent network; a small cap financial that trades far too cheaply for its growth outlook & valuation, in my view.

Happy Saturday. I’m writing this from the couch as I had an itch to type & am waiting for next week to publish my WOSG.L write-up after they report 4Q earnings. Their acquisition of a major jewelry brand’s NA biz last week aligns with the thesis that I’ll be sharing.

Okay, IMXI. This stock was initially put on my radar in 2021 by an investing friend that I’d made the previous year amidst the GME saga. He’s more conservative & concentrated than I am, and had also highlighted ALSN to me back then, which has also proven fruitful.

IMXI is a Miami-based money remitter, here’s their latest deck

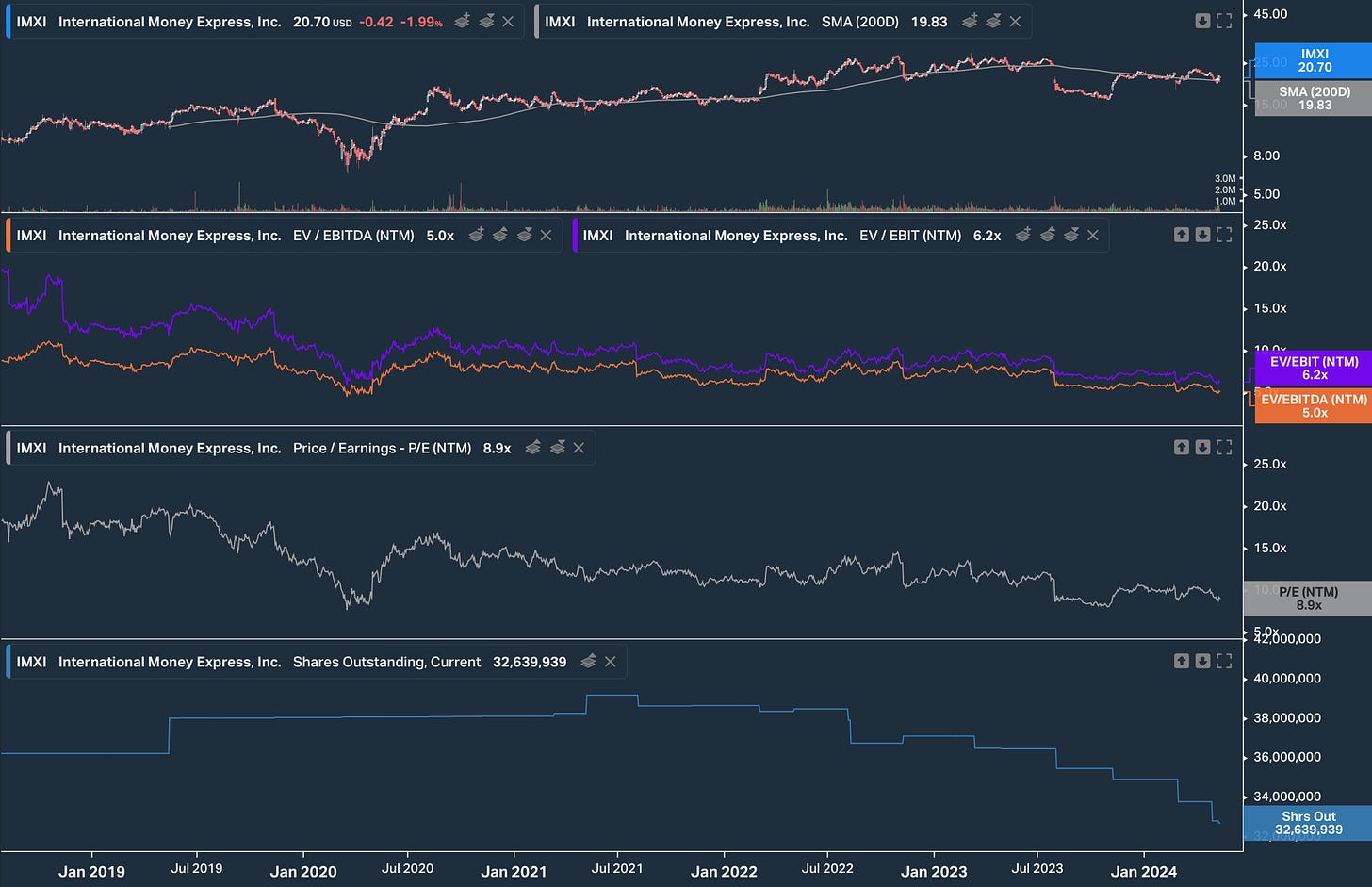

Let’s take a look at how the market has valued this business in the public markets. A pre-Covid de-SPAC that’s been among the best performing SPACs (~12% CAGR since trading began in July 2018). Interestingly, the business has grown/improved at a far faster rate than the share price implies, on a variety of measures, some snipped below:

To me this stock reminds me of the orphans that Einhorn has spoken about. The passive flows market neglects them & they must solve share price malaise through capital return/allocation.

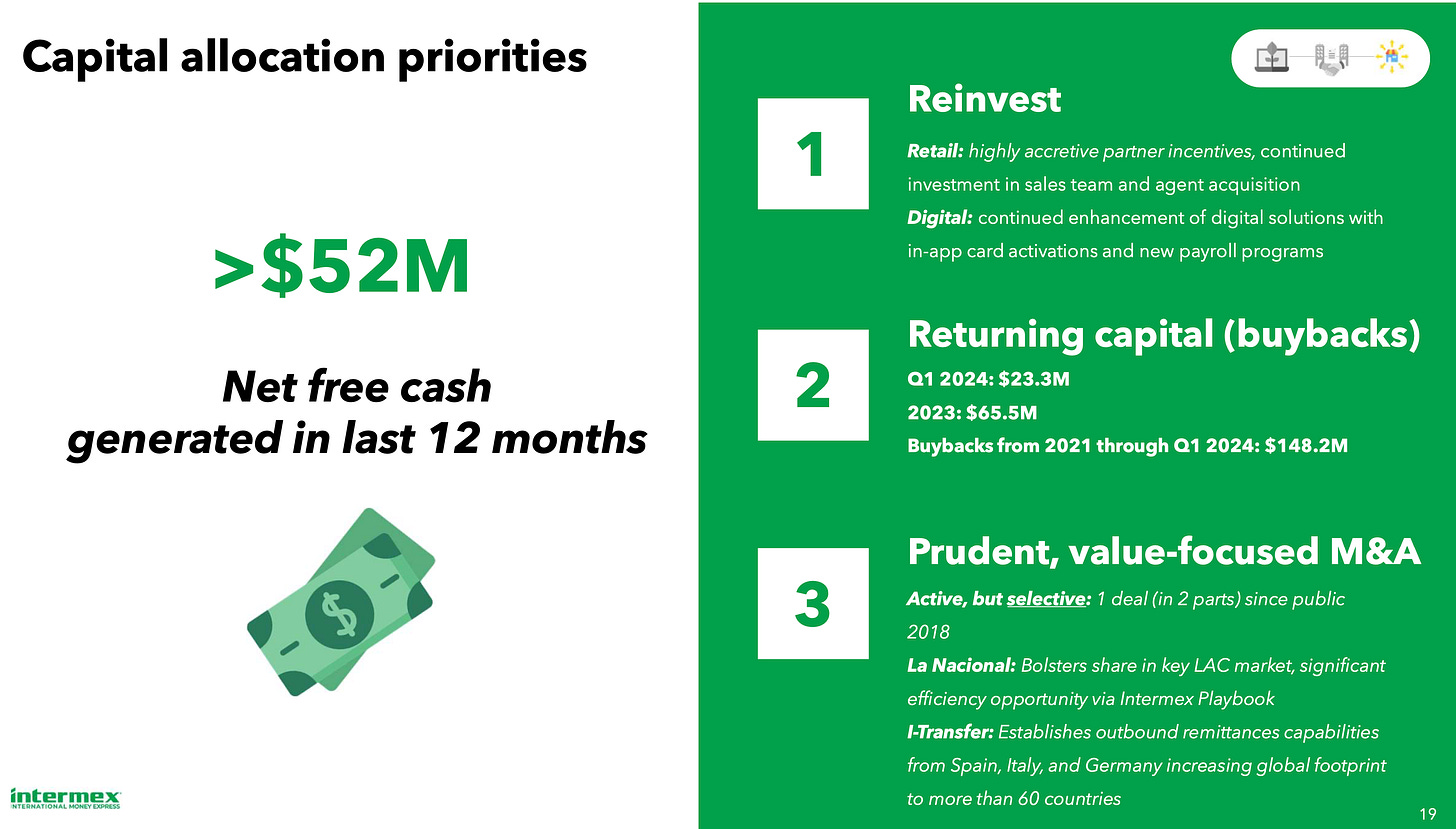

Upon initial trading the market priced IMXI around 9x fwd EV/EBITDA & 20x EV/EBIT. That multiple has compressed to ~5x EV/EBITDA & ~6x EV/EBIT. To me, this implies a business that’s quite mature & expected to begin melting. Given the company’s modest leverage (1.3x debt/adj. EBITDA) & limited capex needs (typically around ~150-250bps of revenues, skewed by a headquarters investment, completed in 1Q24), they’ve had significant excess cash beyond reinvestment need that they have & will continue to return to shareholders.

On new HQ:

~25% larger building that’s proximate to the current HQ (near Dadeland mall, Miami)

"The reason for the relocation is because we are growing so much as a company every year and, as a result of that growth, we added employees and ran out of room here"

I’m not going to get in the weeds on remittances, the individual markets they play in, etc. Breakfast is heading this way, and this brief write-up smattering stream of consciousness has now ended. I hope you’ll look into IMXI and let me know what you think, it’s currently a ~3.3% allocation in my PA.

-Rod